When making real estate investment decisions, one of the most frequently asked questions is whether it is better to invest for cash flow or appreciation.

In this article, we will examine what expert investors have to say about these two investing strategies.

As an investor, you should understand that both strategies are valid and can be combined when evaluating a trade. Therefore, it is important for you to know how to determine the real estate cash flow rate and the purchase a property appreciation rate.

With COVID-19 and the consequent eviction moratorium, many investors cash flowing have had to deal with reduced or negative cash flow and investing for cash flow returns while appreciation rates are through the roof. So, should one invest for real estate cash flow play or for cash flowing property appreciation?

Real Estate Cash Flow Strategy Overview

A cash flow returns strategy offers consistent cash, typically in the form of rent, to real estate investors. Over time, the property may also benefit from appreciation. With equity accumulation, an investor could refinance, sell, and use returns from investing for cash flow and appreciation to invest in new properties.

But it is not always as simple as this. In many cases, you choose one or the other. You could have high investing for cash flow and appreciation when you buy property in a low-cost neighborhood and improve it with some sweat equity. On the other hand, in more developed areas like San Francisco and Washington, D.C., you might find it difficult to find cash flow investments, and therefore have to rely on the appreciation.

Reasons Investors Opt for Investing for Cash Flow

1. If you’re cash-flow positive, rent covers your expenses, e.g., mortgage payment, monthly maintenance fee, insurance, and property taxes, and provides you with extra cash every month.

2. Conventional loans are readily available for cash flow investors. Cash flow is not only used by investors to evaluate deals. Lenders use it too, as mortgage payments will make up a large part of the property’s costs and will definitely affect your cash flow. Lenders use the debt service coverage ratio (DSCR) to determine if, after mortgage payments, a property will be cash-flow positive. To calculate your DSCR, you need to know your net operating income (NOI).

3. Investors who desire financial freedom, passive income, and early retirement will opt for a cash flow strategy because steady cash flow helps you reach your financial goals faster.

4. Rental property appreciation cash returns flow offers more versatility. Instead of a conventional long term rental strategy, you could place your listing on short term or long term rental websites like Airbnb. You could also make monthly income through systems like house hacking rental property appreciation. On a larger scale, you could build a portfolio of both multifamily and single-family rental properties and earn steady rental income.

5. Your cash flow grows over time as you pay down your mortgage and build wealth equity.

The Downside of a Real Estate Cash Flow Strategy

It is more difficult to find cash-flow positive properties, especially in today’s market as prices have appreciated at unexpected rates. In many markets, you’ll readily find cash-flow neutral (property profits can only cover running costs) or cash-flow negative (investor spends some money out of pocket on property maintenance) properties.

Also, cash flow and flow vs appreciation depend on market performance and tenant quality. If there is a real estate downturn, to invest in real estate market cash flow returns get hit. And bad tenants will cause you to lose money.

Real Estate Appreciation Overview

While there are straightforward approaches and formulas for measuring real estate

market cash flow, measuring real estate appreciation presents a challenge. This is probably the main reason why many investors opt for a cash flow strategy.

The best way to measure the current market value of your property is to look at comps (comparable properties) in your area.

How Much Does Real Estate Appreciate on Average?

On average, appreciation rates for real estate agent in the U.S. have stayed between 2% and 4%. In a housing market crash or downturn, property prices could depreciate as they did during the 2008 recession. But in a real estate bubble, as we’re currently experiencing, investors could greatly profit from appreciation.

According to an article on Millionaires:

“Over the past year, the average appreciation of real estate investments has increased 14.5%, a staggering number cash flow compared to historical performance. While many homeowners and real estate investors look to the average home-price valuation as an indicator of future value, it’s important to remember that housing market prices and the rate they appreciate can change dramatically year over year — the current average appreciation rate is 14.5%, a stark difference from 4% in 2019.”

As mentioned before, you can combine real estate appreciation with a rental cash flow strategy or cash flow properties. Rents typically grow over time, leading to increased cash flow. So, a negative cash flow property could turn into positive cash flow over time and also allow you to make a significant profit through appreciation. Essentially, the way to make money with appreciation is last updated when the property is sold. Hence, it is playing a long term game.

Reasons Investors Opt for Real Estate Appreciation

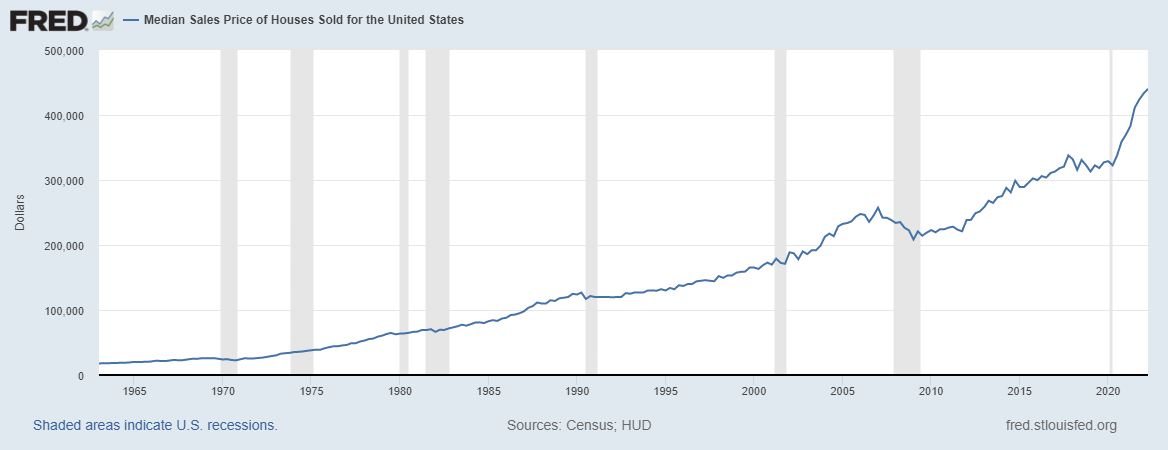

1. Appreciation is a conservative way to make money as an investor. Real estate values usually increase over time, so if you make sound investments, you can sell them for a profit. This chart from the Federal Reserve Bank of St. Louis shows how average home prices in the U.S. have grown since 1963.

2. Appreciation is a great way to pass on real estate prices to younger generations. Hence, lots of people who have already achieved financial independence invest to build wealth appreciation by investing in real estate majorly for investing for appreciation.

3. As a new investor, you can make quick profits via fix-and-flips. You purchase property management and tune it up to make it appreciate in value. Then you sell. You can also buy and hold investing for cash flow, make positive cash flow returns in the interim through rents, then sell.

4. You can defer taxes on investing for appreciation in real estate sales through 1031 exchanges. Although under President Biden’s new policies, 1031 exchanges would only be available to investors making less than $400,000 in annual income.

The Downside of Relying on Investing for Appreciation

When relying on investing for appreciation, you’re making a bet on the market. You have to dig into the city plans, study municipal data, and invest in places close to transport facilities. In other words, you have to keep in mind an eye on where and to which areas people are moving en masse. All the same, you might make a last updated wrong guess.

No one can predict a market crash or what happens when a pandemic hits. Check out some strategies real estate professionals recommend during a market crash.

Depreciation

With both types of rental strategies, you have to worry about depreciation. This PropertyCashin article touches on three main types of depreciation you may have to deal with:

1. Physical depreciation — caused by wear and tear.

2. Functional depreciation — occurs when a function of the building becomes outdated or obsolete. For example, an old down payment multifamily building with no elevator and laundry facilities located in the basement has functionally depreciated in value.

3. External depreciation — the result of an adverse neighborhood or local economic conditions. For example, the closing of a corporate headquarters in one city contributes significantly to the external depreciation of nearby office buildings.

Overall, if you employed an appreciation strategy, you would need to keep your property in pristine condition since you are practically betting on it. And you would most likely have to spend out of pocket on maintenance and tech to make money.

Cash Flow vs. Appreciation: What Investors Say

Tyler Cauble

President, The Cauble Group

“We never invest for appreciation since that is out of our control. Our team selects projects where we can create value and force appreciation through value-add or development from scratch. Any appreciation is just icing on top.”

Riley Adams

CPA, Owner of Young and the Invested

“I readily admit to any hesitation I may have as a real estate investor for buying rental properties with the explicit intention of reselling them in the next few years. I say this because of the tremendous growth we have seen and the specter of rising interest rates in the not-too-distant future as the economy recovers and the Federal Reserve attempts to normalize interest rates.

“For people interested in investing for appreciation in the real estate market at this time, I would advise caution or an investing strategy that involves bidding below what it would have cost to buy a home even three months ago. The inability to purchase price home values or home prices in this market has caused many potential buyers to walk away. This could present some softness in home values or home prices in weaker markets, allowing buyers to bid below asking prices, renovate, rent, and ultimately sell for a profit in the future.”

Dustin Olson

Principal Broker & Owner, Venture DO LLC

“There are multiple ways answer to this question due to the plethora of variables, and all of them may be viable solutions for different investor strategies. But in general, appreciation (not forced) is hypothetical and dependent on the local market, while investing for cash flow rental income is real and more stable.

“If an investor is focused primarily on appreciation rental income (again, not forced), and ‘hopes’ the property’s value will continue to increase in value, just because their property increased in value yesterday, then yes, their down payment return may be higher, but they will also have more risk of increase in value. And many suggest that ‘hope’ is not a viable strategy at all. Typically you will see real estate investor positive cash flow use both metrics, but a property that cash flows with an opportunity for appreciation is a solid real estate investment property rental incomeoverall and if appreciation does not happen, you’re still protected by cash flow and appreciation.

“Now, on the other hand, there are many different variables, but the cornerstone seems to be the investor’s personal financial situation and the desired outcome for the investment property. Investors with less capital to invest generally focus more on cash flow, so they can supplement income, but as their passive income grows, their focus tends to shift more into a balance between the two. Some investors even focus primarily on appreciation only as a place to park capital. So, it’s hard to say that one method is better than the other, and many investors use both measures within their real estate investment property strategy every month

“Keep in mind that the same property with the same purchase price can have very different cash flow rental income scenarios depending on the investor’s location, mortgage rates, holding time, money down, tax benefits protection, deductions, operating expenses, renovation plans, etc. With all these considerations, most investors should focus on their desired overall return on investment (ROI) or internal rate of return (IRR) to determine if their strategy is best for the given investment, rather than just looking at income streams capital gains tax cash flow vs appreciation.

“Many investors will also look for opportunities to force appreciation by reducing expenses and increasing income, through renovations, restructuring, rent increases, etc., to eliminate some of the risks around speculated future appreciation. One good thing, though, is that if an operating expenses property appreciates in value, the rents typically go up, and if your property’s value increases, you may be able to borrow against that equity without even selling cash flow rental income, and stack leveraged equity to invest in more investment properties.”

Parker Webb

Principal, FTW Investments

“Primarily, we employ a value-added strategy. In today’s market, these transactions are not priced for immediate cash flow, but keep in mind we typically target 8%–10% cash on cash within 12–24 months of acquisition. For us, appreciation is about adding short term value or long term by addressing deferred maintenance, improving the look and feel of the properties, improving lighting and security, employing best-in-class management, increasing revenues cash flow rental income, and reducing income streams operating expenses and operating income. Capitalization rates are very low, and we typically underwrite very conservative reversionary cap rates, which means that appreciation comes down to operations or operating expenses, not financial markets.”

Julius Mansa, M.Fin.

Investment Analyst and Lecturer

“I have always been a strong proponent of long term down payment developing and maintaining long term passive income opportunities from the appreciation in real estate business and real estate investments, especially since net rental yields can often gross income invest for cash flow vs be more predictable than equity markets. While I agree that taking advantage of current market trends can yield excellent long term or short term capital returns for investors, the net cash flow and appreciation from rental units can provide an excellent source of income for real estate investors that are seeking operating expenses to expand their appreciation in real estate businesses and real estate investment even further for investment criteria.”

Jonathan Barr

Principal, JB2 Investments

“I would say: always invest for cash flow — but inevitably, increased positive cash flow is followed by appreciation.”

Final Thoughts

There is neither a winner nor a loser. At the end of the day, real estate entrepreneurship has many paths. Both appreciation in real estate appreciation and real estate cash flowing complement each other, real estate investors especially in situations where it is difficult to predict the future. Owning investment strategy or investment criteria properties of real estate investing for appreciation that produce gross income based on both strategies is a good idea.

About the Author:

Agnes A Gaddis is a writer for Inman News, Influencive, and the TSAHC (Texas State Affordable Housing Corporation). She has over 7 years of experience writing for the real estate industry, real estate investors and real estate investing for appreciation. Connect with her on Twitter: @Alanagaddis

Disclaimer: The views and opinions expressed in this blog post are provided for informational purposes only, and should not be construed as an offer to buy or sell any securities or to make or consider any investment

property or course of action.