On Friday, December 22, 2017, tax reform legislation was signed into law by President Trump.

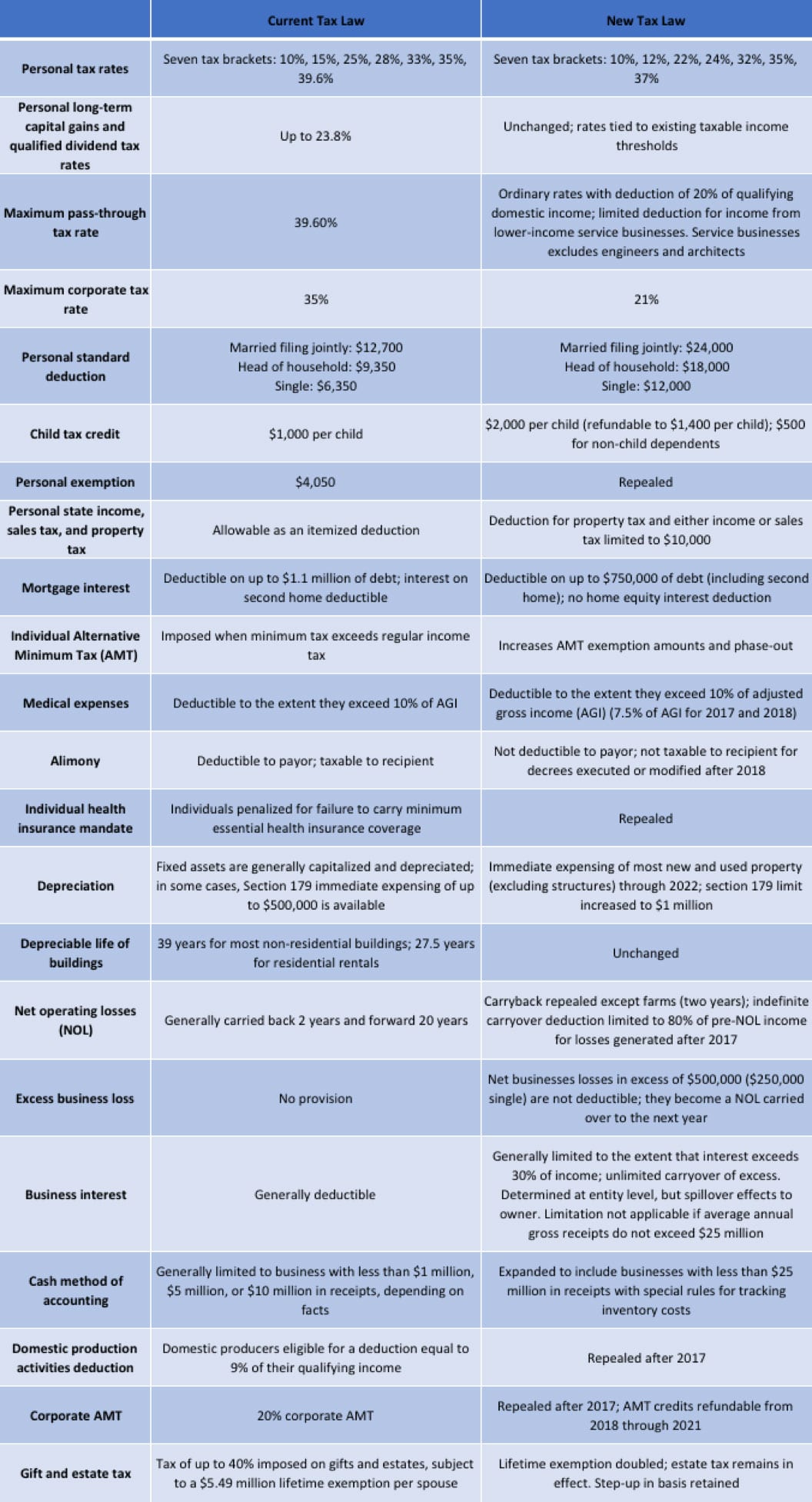

After the tax plan was signed, my business partner and I had a meeting with our CPA to discuss tax strategies for both the remainder of 2017 and for the upcoming year. They also provided us with the chart below, which summarizes the key provisions of the new law. I recommend meeting with your CPA to determine how the tax reform will impact your business and what tax strategies to implement to maximize your benefits.

Credit: John Werlhof, CLA Roseville

Disclaimer: The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting, investment, or tax advice or opinion provided by CliftonLarsonAllen LLP (CliftonLarsonAllen) to the reader. For more information, visit CLAconnect.com.

How do you think real estate entrepreneurs will be impacted by the new tax reform?

Subscribe to my weekly newsletter for even more Best Ever advice: http://eepurl.com/01dAD

If you have any comments or questions, leave a comment below.

Disclaimer: The views and opinions expressed in this blog post are provided for informational purposes only, and should not be construed as an offer to buy or sell any securities or to make or consider any investment or course of action.