One of the main metrics I look at when analyzing a prospective market to invest in is the population growth.

The thought process behind this is simple: if the population is increasing, the demand for real estate is increasing, and vice versa.

Of course, there are other relevant factors like the supply side of the equation. However, there are some investors I’ve met who ONLY select markets based on the net migration. If more people are moving out of the market than are moving in, it is automatically disqualified.

U-Haul is actually a top source for migration data, which they release annually. you can view their migration reports here.

When you understand where people are moving to and moving from, you can adjust your apartment business plan accordingly. If you are in a market with a positive net migration, you are sitting pretty. However, if you are in a market with a negative net migration, there may be trouble on the horizon.

One of the biggest migration trends resulting in part due to the coronavirus pandemic is the urban-to-suburban pipeline.

Not only are more people interested in leaving urban markets, but in some states, such as New York, the exodus has already begun.

The Hill, in their article “Americans leave large cities for suburban areas and rural towns”, says that approximately 250,000 residents plan on moving out of New York City while another two million consider moving out of the state altogether. Also, more than 16,000 New Yorkers already moved to suburban Connecticut.

And this trend isn’t unique to New York.

“A record 27.4% of Redfin.com users looked to move to another metro area in the second quarter of 2020,” reads a Redfin analysis performed in July 2020.

The most popular destinations are Phoenix, Sacramento, Las Vegas, Austin, and Atlanta. Here is a breakdown of the top 10 metros by net inflow of Redfin users and their top origin.

The locations with the large outflows were New York City, San Francisco, Los Angeles, Washington DC, and Chicago. Here is a breakdown of the top 10 metros by net inflow of Redfin users and their top origins.

Are any of your investment markets on either one of these lists?

There is also an increase in demand for rural markets. For example, according to US News, 57% of realtors who responded to their survey said they’ve seen an increase in interest in rural Montana. The main reasons were because of its low coronavirus infection rate, as well as because they grew up and had family there. The same The Hill article cited above said real estate sales in Montana were 10% higher year-over-year, and that rural Colorado, Oregon, and Maine experienced similar increases in sales.

So why are people leaving the urban centers?

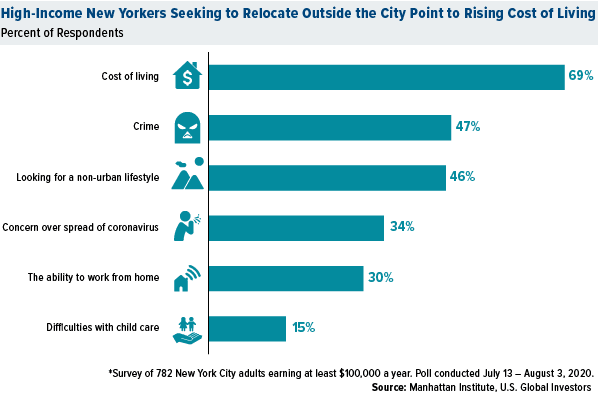

Another telling article was written in NASDAQ entitled “The Urban-to-Suburban Exodus May Be The Biggest in 50 Years.” This article provided more data on the reasons why New Yorkers were fleeing urban centers. The top 5 reasons were cost of living, crime, looking for a non-urban lifestyle, concern over the spread of the coronavirus and the ability to work from home.

One of the major COVID-related changes that is driving more people out of urban centers is working from home.

According to MARKINBLOG, 88% of companies are encouraging or requiring employees to work from home due to COVID and 99% of people prefer to work remotely. Compare this to just 3.4% of the US population working remotely pre-COVID, this has the possibility to massively disrupt real estate, especially the type of real estate that will be demanded.

Since employees aren’t required to go to the office, they are choosing to live in areas that are more affordable, closer to family, and closer to local amenities while still having direct access to a downtown. Hence, they are leaving urban areas for the suburbs.

However, they are also choosing to head to the suburbs due to the type of homes that are offered. For example, people are looking for more outdoor spaces (whether that is a private yard or nearby greenspaces and parks) and homes with an extra room to convert into a home office. Greenspace is universally nonexistent in a lot of urban areas, and the cost of an extra bedroom in urban areas is also financially unrealistic for many would be buyers and renters. Therefore, if they want to see real green grass and trees, as well as have a home office, the suburbs or rural areas are their only options.

What this means for you?

As a multifamily real estate investor, you need to understand the population and migration trends in your investment market.

If you are heavily invested in major urban centers, it may be time to consider a pivot and diversify into suburban areas.

This is great news for those already invested in suburban areas, as you should benefit from both an increase in rents as well as an increase in value due to falling cap rates.

Newer investors can take advantage of the low barrier of entry since real estate is generally more affordable in suburban and rural markets.

No one knows for certain what the future holds for real estate post-COVID. However, due to other factors leading up to the pandemic (which I outline in my article about why I am confident in multifamily) combined with the migration trend outlined in this article, I believe multifamily real estate in suburban areas will thrive in the years to come.

Disclaimer : The views and opinions expressed in this blog post are provided for informational purposes only, and should not be construed as an offer to buy or sell any securities or to make or consider any investment or course of action.