Last Updated on 10/10/18

So you want to become a multifamily syndicator? Well, you aren’t alone. “How do I break into the multifamily syndication business?” is the most common question I receive.

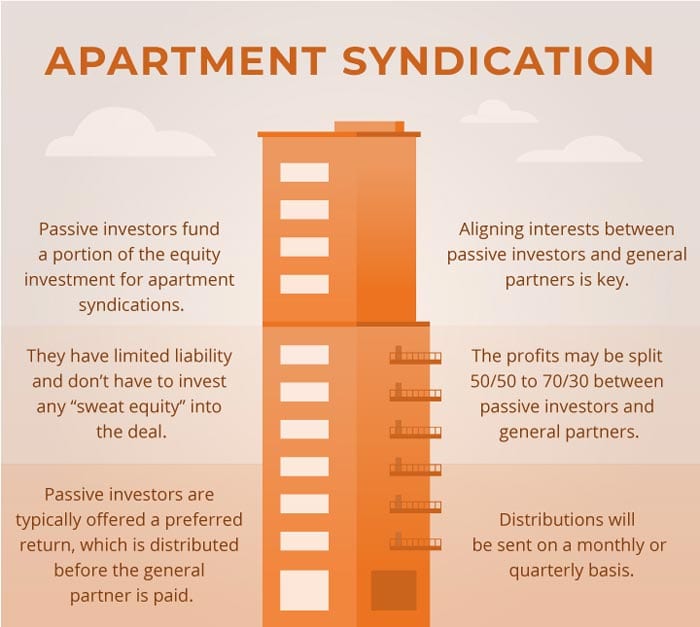

Multifamily or apartment syndication is simply raising money from passive investors and buying apartment buildings. I have been in the syndication business for many years, and once you have cultivated the four skill sets needed prior to raising money for apartment deals (learn what those are here), I’ve discovered 6 creative ways for those interested to get their foot in the door:

- Find an off-market deal.

- Conservatively underwrite deals.

- Negotiate terms and get all legal docs in order.

- Raise capital for the deal and be the ongoing point person for capital sources.

- Secure debt financing (if applicable).

- Do property management.

What area appeals to you most about multifamily syndication? What do you want to do? How do you want to spend your time?

And if you’re thinking “none of the above, Joe. I just want to cut a check and have my money and others work for me so I can be a passive investor” then, if you are an accredited investor, you can connect with me , and we’ll set up a call so we can get to know each other better. That way you can be one of the first people to get access to my next deal.

But, if you’re going to be successful in multifamily syndication, then you’ll need to choose your primary area of focus. From experience, I can tell you that if you try to do it all, you’re doing your investors and yourself a huge disservice.

Related: The 22 Tactics to Go from a Corporate Job to $400,000,000 in Multifamily Real Estate

So, here you go, the 6 ways to break into the apartment syndication biz:

#1 Find an Off-Market Deal

You can get into the biz by finding a deal and bringing it to an experienced investor who can close on it. I put together a guide that lists 24 Ways to Find Off-Market Deals. If you haven’t seen it yet then opt-in to my weekly newsletter, and it will be sent to you automatically.

But wait, before you actually look for multifamily syndication deals or bring it to an experienced investor, figure out what investors you can take it to. First, ensure you’re not doing unnecessary work by qualifying them and ensuring they:

- Have closed on properties that are similar to the one you bring to the table

- Will structure the agreement to meet your goals (more about this below)

- Come with trusted references you can contact – don’t enter into an agreement without vetting the investor. When you’re bringing in investor money, that partnership major implications for all the involved parties.

When you find a great multifamily syndication deal, should you be compensated with a finder’s fee? Or would you rather be an equity partner in the multifamily syndication deal?

While it’s great to get a fee for finding a deal, I would personally prefer the long-term benefits of being in a deal. Of course, you might need to get a finder’s fee for the first couple deals in order to survive and pay your bills. Speaking from experience, it’s worth about $25k-100k (depending on the size and how good of a deal it is) for someone to come to me with an off-market deal I’m interested in.

The more deals you bring to the table, however, the more you should be able to become an equity partner on the deals you find, ultimately setting you up for the long-term financial freedom we all seek.

Related: The Most Unique Way to Find Off-Market Apartment Deals

#2 Conservatively Underwrite Multifamily Syndication Deals

If you’re an underwriter or are willing to learn this skill, you can also break into the biz by offering your expertise to a group (or individual) who has no issue finding deals but may need help underwriting them.

For example, my business partner and I brought on some UCLA students who were earning their MBA. They helped us with the initial underwriting on the tons of deals we had. After they worked their magic, we just had to complete the final analysis. Once each deal closed, we paid them $10k and offered them the long-term potential to be in on future deals as we grow our business.

#3 Negotiate Terms and Get all Legal Docs in Order

You can get into the biz by earning a degree in law. Go ahead and skip to #4 if you’re not currently an attorney and don’t wish to earn a law degree. Honestly, if you don’t already have some law experience, this may not be the most direct way to break into the multifamily syndication business. If you do, however, it may be effective.

You can get into the biz by earning a degree in law. Go ahead and skip to #4 if you’re not currently an attorney and don’t wish to earn a law degree. Honestly, if you don’t already have some law experience, this may not be the most direct way to break into the multifamily syndication business. If you do, however, it may be effective.

You may not be the one negotiating the terms of the deal, since you likely didn’t acquire it. That means your main responsibility as a legal counsel will be to prepare the legal documents. Many involved in real estate investing prefer to just pay for outsourced attorneys on syndicated deals, rather than paying the sometimes much higher cost of bringing in an attorney as a partner.

To be really valuable as a potential partner, you may have to bring other things to the table on top of your law experience. This is especially true if you wish to join a group of investors who have grown to the point of needing in-house counsel.

Related: Four Legal ways to Get Paid Raising Capital for Apartment Deals

#4 Raise Capital for Deal and Be Ongoing Point Person for Capital Sources

If you’re willing to raise capital and be the point person on a deal, you could get into the biz by partnering with someone highly experienced in the multifamily syndication business. This means someone with a successful track record who can show you how much they made on past deals. This will give you an idea of how much you can make on future deals.

Even though your partner should have money in the deal (beware if they don’t, because what happens if the deal flops), you will align your interests by bringing in more money. Maybe you have professional connections to high-net-worth people who can offer financial backing for a deal your experienced partner is working on. This is only true, however, if your potential partner and investor connection think you’re a savvy enough business person.

Remember, if you are raising capital for a deal someone else acquired, you have to join as a general partner, unless you have a Securities License. Without this, raising money for deals you’re not on the General Partnership side of is against the law. Regardless, you should talk to a securities attorney before proceeding with any of the above.

Want to get started raising capital? Here are over 20 blog posts about all things money-raising, which I learned from raising over $100,000,000 in capital from passive investors.

#5 Secure Debt Financing

Mortgage brokers can get into the biz using this creative method. So, if you aren’t a mortgage broker or don’t want to be one then skip to #6.

Mortgage brokers can get into the biz using this creative method. So, if you aren’t a mortgage broker or don’t want to be one then skip to #6.

Like #3, even if you are a mortgage broker, you will usually earn a fee rather than come in on the General Partnership side. I know of some groups, however, that comprise of mortgage brokers who come into deals by using their brokerage fee as their part of the equity.

Related: How a Syndicator Secures Financing for an Apartment Deal

#6 Do Property Mgmt.

As an experienced property manager, you have many of ways of breaking into the business. Here are some:

- By networking with local, aspiring investors who want to complete deals but don’t have the track record, you can bring your team’s track record of turning deals around. They bring the money for the deal. You have leverage here because, without you or another property manager, they couldn’t get approved for debt financing and likely have trouble raising the equity another way).

- Work with an experienced group by offering to exchange your property management fees for a chance to be in on their next deal. This could help them sell the deal to their investors because it shows an alignment of interests. You have less leverage than the above scenario but still provide a lot of value.

You could combine these methods and raise money for multifamily syndication deals while also trading your property mgmt. fees for being involved in the deal. The more money you raise, the more equity you get in the deal.

Or, you could raise money for the deal and get equity but not trade in your property mgmt. fees even though you’re managing the deal. Basically, you can slice it a lot of different ways – only limited by your creativity and ability to add value to the deal. Ultimately your ownership should be proportionate to the value you add to the deal.

Related: 4 Ways to Partner with a Property Management Company on Your First Apartment Syndication Deal

Bonus Strategies

- if you’re a broker then put in your commission to join a multifamily syndication opportunity. On my first multifamily deal (a 168 unit), the brokers offered their commission of $317,500 to become owners in the deal. It was a win-win because my group had to bring less money, and they got to re-invest their commission into something that had major upside.

- If you have experience in multifamily investing but don’t want to deal with the headaches of finding opportunities, then you could complete asset management for other investors. Just check out this interview I did with an asset manager, and hear how much he gets paid: https://joefairless.com/blog/podcast/jf140-how-much-do-multifamily-asset-managers-get-paid/

Related: Working in Apartment Syndication – What’s Possible in One Year!

Conclusion

I have explained many different creative ways to enter into the multifamily syndication business. Once you are ready to become a syndicator, here are six tips for how to get started:

- Find an off-market deal.

- Conservatively underwrite deals.

- Negotiate terms, and get all legal docs in order.

- Raise capital for deals and be the ongoing point person for capital sources.

- Secure debt financing (if applicable).

- Do property management.

If “how to break into the multifamily syndication business?” is the number one question I receive, “how do I raise money from private investors?” is a close second. I’ve written multiple posts on proven methods successful investors I’ve interviewed on my podcast are using to raise capital, six of which I’ve shared below.

- My Four-Step Apartment Syndication Money-Raising Process

- 3 Ways to Raise Over $1 Million for Your 1st Apartment Syndication

- A 5-Step Process for Raising BIG Capital For Multifamily Syndication

- 4 Principles to Source Capital from High Net-Worth Individuals

- 4 Non-Obvious Ways to Raise Private Money for Apartment Deals

- How to Overcome Objections When Raising Money for Multifamily Investing

These are more great resources you should check out if you want to know how to buy a multifamily property with a degree of success.

Are you a newbie or a seasoned investor who wants to take their real estate investing to the next level? The 10-Week Apartment Syndication Mastery Program is for you. Joe Fairless and Trevor McGregor are ready to pull back the curtain to show you how to get into the game of apartment syndication. APARTMENT SYNDICATION MASTERY to learn how to get started today.

Disclaimer: The views and opinions expressed in this blog post are provided for informational purposes only, and should not be construed as an offer to buy or sell any securities or to make or consider any investment or course of action.